tax lien sales colorado

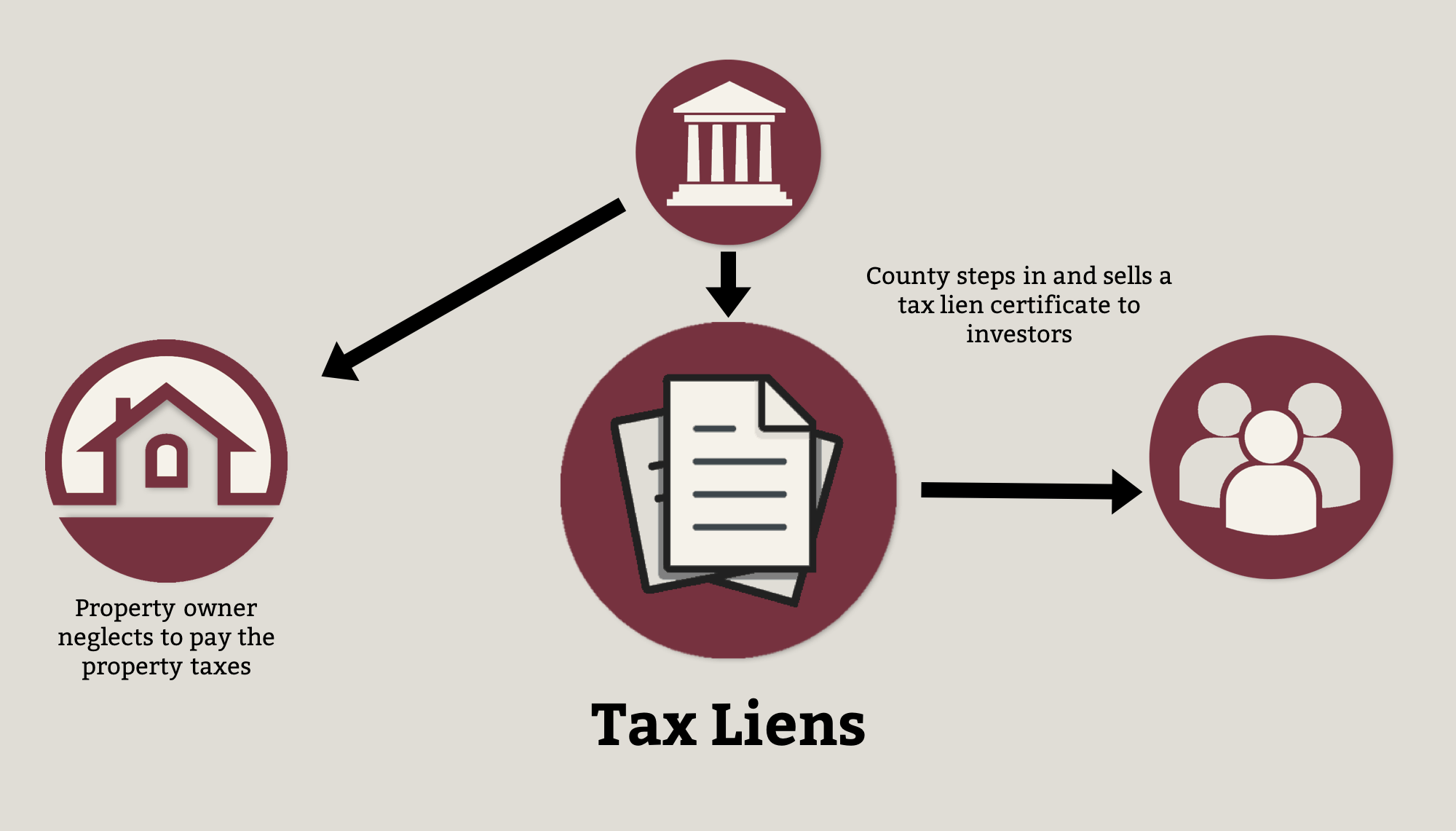

If the property owner does not pay the property taxes by late October the county sells the tax lien at the annual tax lien sale. So the county gets the certificate of purchase and can eventually get title to your home.

Colorado County Treasurers And Public Trustees Associations

CDOR will send a Notice of Intent to Issue JudgmentLien to the taxpayers last known address.

. Please check back for more information. Right to Redeem After a Tax Lien Sale Generally. A tax lien is placed on every county property owing taxes on January 1 each year and remains until the property taxes are paid.

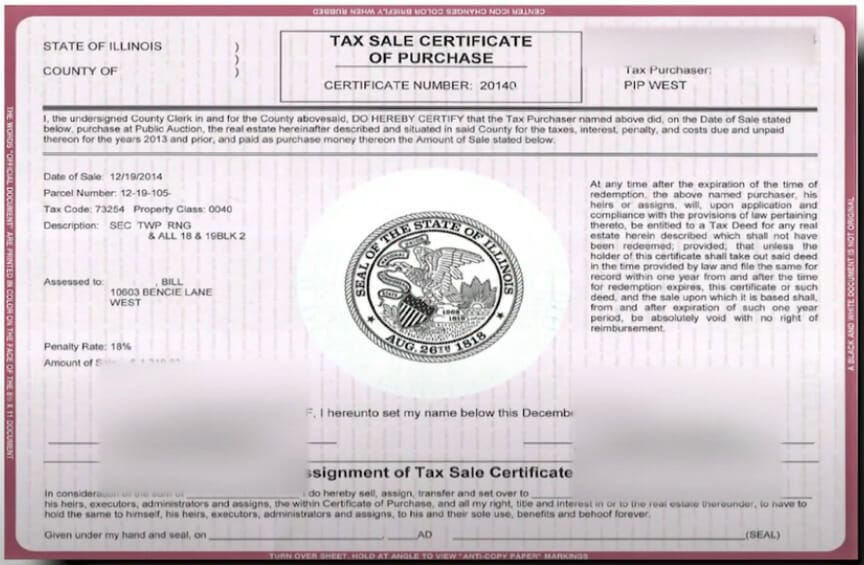

When you purchase a tax lien sale certificate on property you become a lienholder on the property. Enjoy the pride of homeownership for less than it costs to rent before its too late. About the Tax Lien Sale.

Many counties conduct their sales online or have a private company such as Realauction conduct the sales for them. THERE WILL BE AN 800 ONLINE FEE ADDED PER ACCOUNT THIS FEE IS NOT RETURNED IF TAX LIEN IS REDEEMED. The sale will be administered by RealAuction and is conducted with the goal of fairness and efficiency.

These liens draw interest. Ad Compare foreclosed homes for sale near you by neighborhood price size schools more. Purchasing delinquent tax liens at sale is a popular form of investment.

Ad Find Tax Lien Property Under Market Value in Colorado. The Morgan County Real Estate Tax Lien Sale was held via the Internet November 16 - 18 2021. For any questions about Tax Lien Sales please contact our office at 303 795-4550.

The 2021 Tax Lien Sale will be held online on a date TBA. Tax Lien Sale Statistics. The two files below provide a list of the properties with delinquent property taxes for this years tax lien sale.

Larimer County Fairgrounds at the Ranch 5280 Arena Circle Loveland CO Mailing List. Taxes may be redeemed by the owner thereof or his agent assignee or attorney or by any. For support call SRI Inc.

Tax liens offer many opportunities for you to earn above average returns on your investment dollars. In essence you loan funds to the owner to. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales.

These tax liens will be reflected on the tax lien sale record in the Treasurers office. In addition the tax liens available for sale are listed on the auction web site. ANNUAL INTERNET TAX LIEN SALE November 5th 2021.

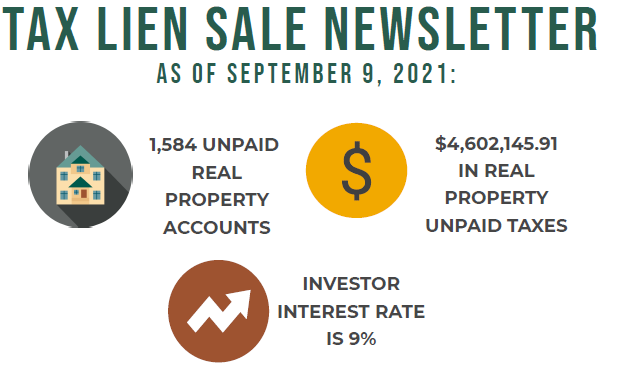

Colorado 2022 Tax Lien Sale Dates 2022 Tax Lien Sale Redemption Interest Rate - TBD Rates Set by State Bank Commissioner Sorted by County. There are currently 40702 tax lien-related investment opportunities in Colorado including tax lien foreclosure properties that are either available for sale or worth pursuing. The interest rate for the 2021 tax lien sale has been set at 9 by the State of Colorado Bank Commissioner.

The 2021 Tax Lien Sale took place on November 18 2021 in the Thomas McKee 4-H Community Building located at. The 2021 Tax Lien Sale will be held Wednesday November 10th on the internet. The tax lien sale is the final step in the treasurers efforts to collect taxes on real property.

The delinquent property tax list is advertised in The Fort Morgan Times. Many of the tax bills for the listed properties will be paid before the tax lien sale and will not be offered for bids at the sale. For the most current list of properties still available for the tax lien sale please visit the SRI auction site starting Tuesday October 26 2021.

A holder of a Tax Lien Sale Certificate has the right to pay all subsequent years taxes which remain unpaid after all due dates expire. There are currently 11 red-hot tax lien listings in Colorado County TX. Here are some facts to help you understand what a tax lien sale investment is and is NOT.

Buyers must rely entirely on their own information judgment and inspection of the property records. The Colorado Department of Revenue CDOR is authorized to file a judgmentlien to collect your unpaid tax debt 39-21-114 3 CRS. If you would like to receive a copy of the delinquent property advertising tabloid for the tax lien sale please send 500 check to.

2021 Tax Lien Sale Interest Rate is 9. Tax Lien Sale Real property and mobile home delinquent taxes are enforced through the annual Tax Lien Sale. This is a courtesy letter to allow the taxpayer one final chance to pay their tax debt.

Check your Colorado tax liens rules. Click here for the Zeus Auction website. Person having a legal or equitable claim therein or by a holder of a tax sale certificate.

9 plus federal discount rate. A tax lien was sold under the provisions of Article 11 of Title 39 as a result of delinquent. If you do not see a tax lien in Colorado CO or property that suits you at this time subscribe to our email alerts and we will update you as new.

Ad Find The Best Deals In Your Area Free Course Shows How. These tax foreclosed homes are available for pennies on the dollar - as much as 75 percent off full market price and more. Detailed listings of foreclosures short sales auction homes land bank properties.

View Tax Sale Information for detailed instructions on how the online tax lien sale works. Here is a summary of information for tax sales in Colorado. If no one bids on the lien at the sale the county treasurer will strike off the unsold lien to the county or city town or city and county.

10112021 - AUCTION SITE OPENS FOR REGISTRATION AND RESEARCH. The Tax Lien Sale Site is open for registration year-round. In most states delinquent taxpayers get some time during which they can.

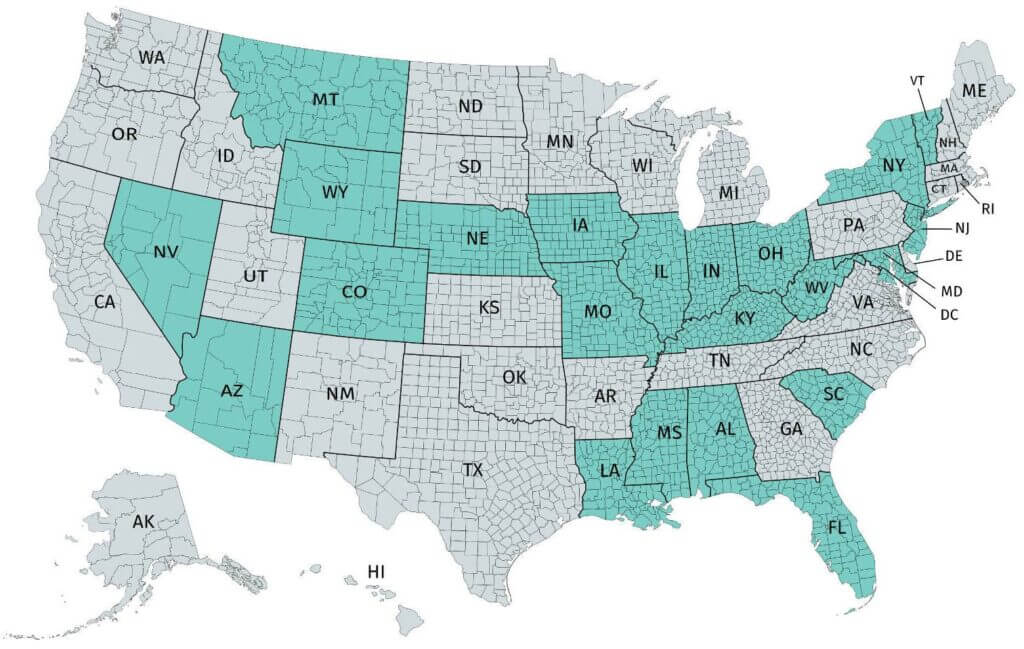

It is the buyers responsibility to know the quality of the property on which they are paying the taxes and receiving a lien. Just remember each state has its own bidding process. Colorado is a good state for tax lien certificate sales.

REGISTRATION CLOSES AT 1200pm November 4th 2021 -.

Tax Liens The Complete Guide To Investing In New Jersey Tax Liens Paperback Overstock Com Shopping The Best Deals On G Investing Books Bestselling Books

Make Money With Tax Liens Know The Rules Ted Thomas

Colorado Tax Lien Auctions News With Stephen Swenson Of Tax Sale Support Learn About How Colorado Tax Lien Work And How Investing Ebook Series Training Video

Notice Of Purchase Of Real Estate At Tax Lien Sale And Of Application For Issuance Of Treasurer S Deed Dove Creek Press

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Tax Lien Truths The Mountain Jackpot News

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Make Money With Tax Liens Know The Rules Ted Thomas

Tony Martinez Asks If You Have Considered The Possibility Of Purchasing An Investment Property With An Existing Tenant Discover Investing Tax Mortgage Payoff

Tax Lien Investing Is A Game Even Hedge Funds Can Like The Denver Post

Tax Lien Foreclosures On Properties Due To Nonpayment Of Property Tax Are Common Nowadays Foreclosures Buying A Foreclosure Avoid Foreclosure

Tax Deed And Tax Lien Investing Ebook

Sell House Before Property Tax Foreclosure Oregon Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe Delinquent Property Taxes

Secrets Of Tax Lien Investing Tax Sale Investment Type Tax Lien States Tax Deed States And Redemption Deed States Tax Help Tax Prep Investing

Tax Lien Investing Pros And Cons Youtube